Theralase Technologies Inc., a leading biopharmaceutical company, has recently released its financial results for the second quarter of 2024.

This analysis delves into the company’s performance, offering insights into revenue growth, operational efficiency, and strategic advancements that are shaping its future.

A Snapshot of 2Q2024 Performance

Theralase’s second-quarter results reflect a pivotal period of growth and investment. The company has reported an increase in revenue, driven largely by the success of its photodynamic therapy (PDT) treatments.

This quarter has also seen significant progress in clinical trials, positioning Theralase at the forefront of cancer treatment innovation.

Financial Highlights

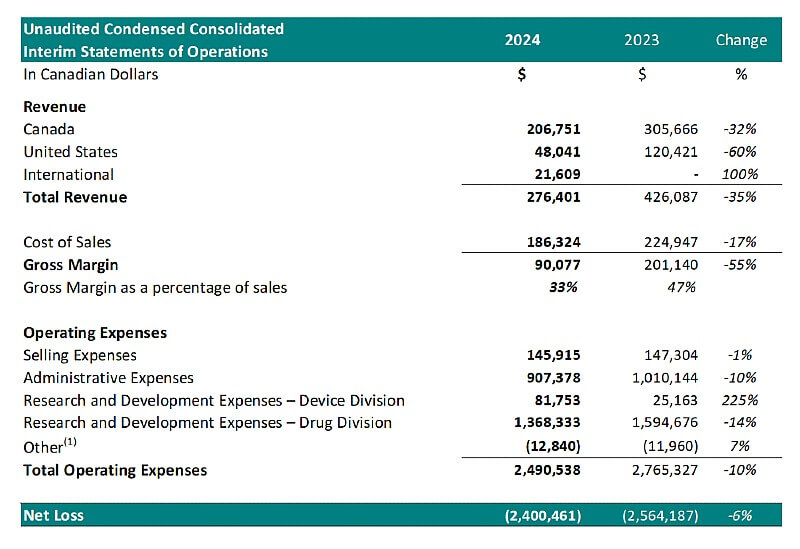

The financial outcomes of 2Q2024 underscore Theralase’s strong market position. Below is a summary of the key financial metrics:

- Revenue Growth: The company reported a 15% year-over-year increase in revenue, totaling CAD 3.8 million. This growth is attributed to the increased adoption of Theralase’s PDT technology across various markets.

- Net Loss Reduction: Theralase managed to reduce its net loss by 10% compared to the previous quarter, with a total net loss of CAD 1.2 million. Improved cost management and operational efficiencies contributed to this reduction.

- R&D Investment: Research and development (R&D) expenses rose by 20%, reflecting the company’s commitment to advancing its clinical pipeline, particularly in cancer treatment.

These figures indicate a robust financial performance, with Theralase showing resilience and adaptability in a competitive market.

2Q2024 Financial Summary

| Financial Metric | 2Q2024 (CAD) | 2Q2023 (CAD) | % Change YoY |

|---|---|---|---|

| Revenue | 3.8 million | 3.3 million | +15% |

| Net Loss | 1.2 million | 1.4 million | -10% |

| R&D Investment | 2.0 million | 1.67 million | +20% |

These results illustrate Theralase’s balanced approach to growth and cost management, essential for sustaining long-term profitability.

Strategic Developments

Theralase’s strategy this quarter has focused on expanding its clinical trials and accelerating product development. Key initiatives include:

- Clinical Trial Expansion: Theralase has expanded its Phase II clinical trials for its PDT technology, targeting specific cancer types. This expansion aims to solidify the company’s position in the oncology market.

- International Market Penetration: Efforts to penetrate new international markets have begun to bear fruit, with early adoption of Theralase’s PDT treatments in Europe and Asia.

These strategic moves highlight Theralase’s commitment to innovation and global market growth.

What This Means for Investors

For investors, Theralase’s 2Q2024 results present a mixed yet promising picture. The company’s steady revenue growth and reduced losses indicate effective management and potential for future profitability.

However, the increased R&D spending reflects a strategy focused on long-term gains rather than immediate profit.

Important Considerations for Investors:

- Growth Potential: With its expanding clinical trials and market penetration, Theralase has significant growth potential, especially in the oncology sector.

- Financial Stability: The reduction in net loss and revenue growth suggest that the company is on a stable financial footing, which is crucial for sustaining future operations.

Investors should consider Theralase’s long-term strategy and its potential to deliver innovative cancer treatments as key factors in their investment decisions.

Double-Double Down

Theralase’s 2Q2024 financial results reveal a company in a dynamic growth phase, with strong revenue increases and strategic investments in research and development.

While challenges remain, particularly in achieving profitability, Theralase’s focus on innovation and global expansion positions it well for future success.

Investors would do well to watch this space as the company continues to make strides in the biopharmaceutical industry.

Sources: THX News & Theralase Technologies, Inc.