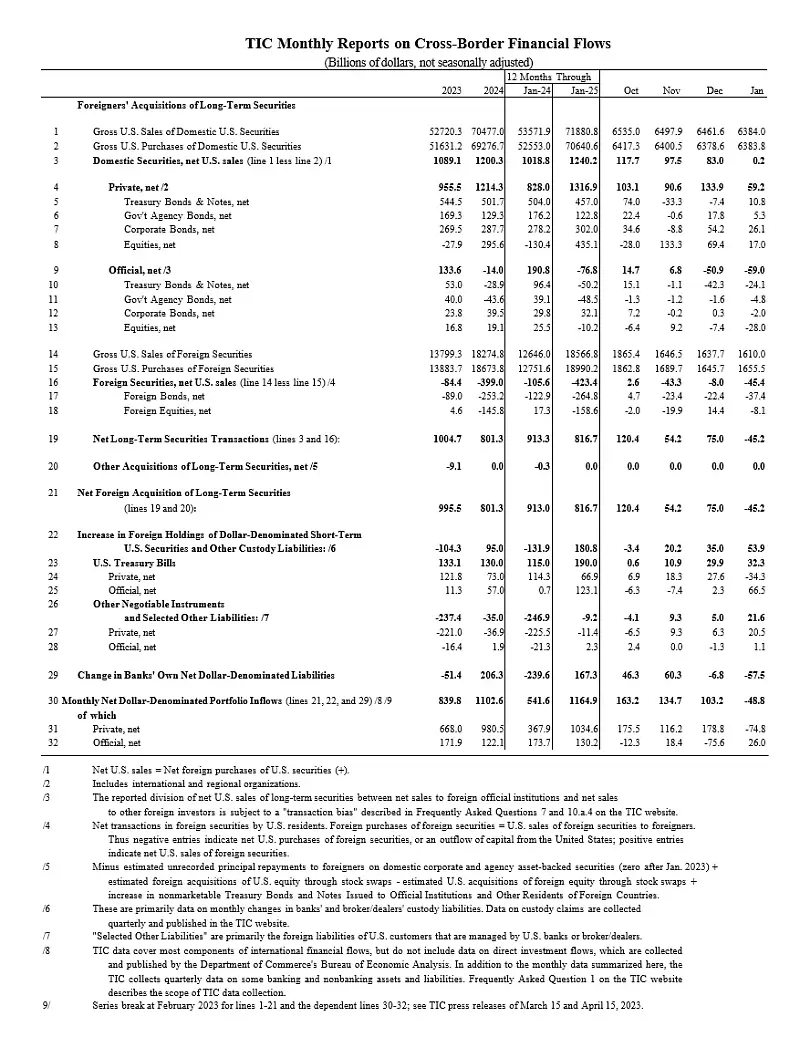

The U.S. Department of the Treasury released January 2024 Treasury International Capital (TIC) data, revealing a net outflow of $48.8 billion, driven by foreign private outflows and official inflows.

This shift in capital flows highlights evolving global economic interactions and potential impacts on U.S. financial markets.

Capital Movements

In January 2024, the TIC data indicated a net outflow of $48.8 billion from the United States. This figure comprises $74.8 billion in net foreign private outflows and $26.0 billion in net foreign official inflows.

Foreign residents increased their holdings of long-term U.S. securities by a marginal $0.2 billion, with private investors purchasing $59.2 billion while official institutions sold off $59.0 billion.

Investment Shifts

- U.S. residents expanded their holdings of long-term foreign securities by $45.4 billion.

- Foreign residents boosted their holdings of U.S. Treasury bills by $32.3 billion.

- Total dollar-denominated short-term U.S. securities held by foreigners rose by $53.9 billion.

- Banks’ net dollar-denominated liabilities to foreign residents decreased significantly by $57.5 billion.

TIC Monthly Reports on Cross-Border Financial Flows

(Billions of dollars, not seasonally adjusted)

| Line | Description | Annual | 12 Months Through | Monthly | |||||

|---|---|---|---|---|---|---|---|---|---|

| 2023 | 2024 | Jan-24 | Jan-25 | Oct | Nov | Dec | Jan | ||

| 1 | Gross U.S. Sales of Domestic U.S. Securities | 52,720.3 | 70,477.0 | 53,571.9 | 71,880.8 | 6,535.0 | 6,497.9 | 6,461.6 | 6,384.0 |

| 2 | Gross U.S. Purchases of Domestic U.S. Securities | 51,631.2 | 69,276.7 | 52,553.0 | 70,640.6 | 6,417.3 | 6,400.5 | 6,378.6 | 6,383.8 |

| 3 | Domestic Securities, net U.S. sales (line 1 less line 2) | 1,089.1 | 1,200.3 | 1,018.8 | 1,240.2 | 117.7 | 97.5 | 83.0 | 0.2 |

| 4 | Private, net | 955.5 | 1,214.3 | 828.0 | 1,316.9 | 103.1 | 90.6 | 133.9 | 59.2 |

| 5 | Treasury Bonds & Notes, net | 544.5 | 501.7 | 504.0 | 457.0 | 74.0 | -33.3 | -7.4 | 10.8 |

| 6 | Gov’t Agency Bonds, net | 169.3 | 129.3 | 176.2 | 122.8 | 22.4 | -0.6 | 17.8 | 5.3 |

| 7 | Corporate Bonds, net | 269.5 | 287.7 | 278.2 | 302.0 | 34.6 | -8.8 | 54.2 | 26.1 |

| 8 | Equities, net | -27.9 | 295.6 | -130.4 | 435.1 | -28.0 | 133.3 | 69.4 | 17.0 |

| 9 | Official, net | 133.6 | -14.0 | 190.8 | -76.8 | 14.7 | 6.8 | -50.9 | -59.0 |

| 10 | Treasury Bonds & Notes, net | 53.0 | -28.9 | 96.4 | -50.2 | 15.1 | -1.1 | -42.3 | -24.1 |

| 11 | Gov’t Agency Bonds, net | 40.0 | -43.6 | 39.1 | -48.5 | -1.3 | -1.2 | -1.6 | -4.8 |

| 12 | Corporate Bonds, net | 23.8 | 39.5 | 29.8 | 32.1 | 7.2 | -0.2 | 0.3 | -2.0 |

| 13 | Equities, net | 16.8 | 19.1 | 25.5 | -10.2 | -6.4 | 9.2 | -7.4 | -28.0 |

| 14 | Gross U.S. Sales of Foreign Securities | 13,799.3 | 18,274.8 | 12,646.0 | 18,566.8 | 1,865.4 | 1,646.5 | 1,637.7 | 1,610.0 |

| 15 | Gross U.S. Purchases of Foreign Securities | 13,883.7 | 18,673.8 | 12,751.6 | 18,990.2 | 1,862.8 | 1,689.7 | 1,645.7 | 1,655.5 |

| 16 | Foreign Securities, net U.S. sales (line 14 less line 15) | -84.4 | -399.0 | -105.6 | -423.4 | 2.6 | -43.3 | -8.0 | -45.4 |

| 17 | Foreign Bonds, net | -89.0 | -253.2 | -122.9 | -264.8 | 4.7 | -23.4 | -22.4 | -37.4 |

| 18 | Foreign Equities, net | 4.6 | -145.8 | 17.3 | -158.6 | -2.0 | -19.9 | 14.4 | -8.1 |

| 19 | Net Long-Term Securities Transactions (lines 3 and 16): | 1,004.7 | 801.3 | 913.3 | 816.7 | 120.4 | 54.2 | 75.0 | -45.2 |

| 20 | Other Acquisitions of Long-Term Securities, net | -9.1 | 0.0 | -0.3 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 21 | Net Foreign Acquisition of Long-Term Securities (lines 19 and 20): | 995.5 | 801.3 | 913.0 | 816.7 | 120.4 | 54.2 | 75.0 | -45.2 |

| Line | Description | Annual | 12 Months Through | Monthly | |||||

|---|---|---|---|---|---|---|---|---|---|

| 2023 | 2024 | Jan-24 | Jan-25 | Oct | Nov | Dec | Jan | ||

| 22 | Increase in Foreign Holdings of Dollar-Denominated Short-Term U.S. Securities and Other Custody Liabilities: | -104.3 | 95.0 | -131.9 | 180.8 | -3.4 | 20.2 | 35.0 | 53.9 |

| 23 | U.S. Treasury Bills | 133.1 | 130.0 | 115.0 | 190.0 | 0.6 | 10.9 | 29.9 | 32.3 |

| 24 | Private, net | 121.8 | 73.0 | 114.3 | 66.9 | 6.9 | 18.3 | 27.6 | -34.3 |

| 25 | Official, net | 11.3 | 57.0 | 0.7 | 123.1 | -6.3 | -7.4 | 2.3 | 66.5 |

| 26 | Other Negotiable Instruments and Selected Other Liabilities: | -237.4 | -35.0 | -246.9 | -9.2 | -4.1 | 9.3 | 5.0 | 21.6 |

| 27 | Private, net | -221.0 | -36.9 | -225.5 | -11.4 | -6.5 | 9.3 | 6.3 | 20.5 |

| 28 | Official, net | -16.4 | 1.9 | -21.3 | 2.3 | 2.4 | 0.0 | -1.3 | 1.1 |

| 29 | Change in Banks’ Own Net Dollar-Denominated Liabilities | -51.4 | 206.3 | -239.6 | 167.3 | 46.3 | 60.3 | -6.8 | -57.5 |

| 30 | Monthly Net Dollar-Denominated Portfolio Inflows (lines 21, 22, and 29) | 839.8 | 1,102.6 | 541.6 | 1,164.9 | 163.2 | 134.7 | 103.2 | -48.8 |

| 31 | Private, net | 668.0 | 980.5 | 367.9 | 1,034.6 | 175.5 | 116.2 | 178.8 | -74.8 |

| 32 | Official, net | 171.9 | 122.1 | 173.7 | 130.2 | -12.3 | 18.4 | -75.6 | 26.0 |

Footnotes:

- Net U.S. sales = Net foreign purchases of U.S. securities (+).

- Includes international and regional organizations.

- The reported division of net U.S. sales of long-term securities between net sales to foreign official institutions and net sales to other foreign investors is subject to a “transaction bias” described in Frequently Asked Questions 7 and 10.a.4 on the TIC website.

- Net transactions in foreign securities by U.S. residents. Foreign purchases of foreign securities = U.S. sales of foreign securities to foreigners. Thus negative entries indicate net U.S. purchases of foreign securities, or an outflow of capital from the United States; positive entries indicate net U.S. sales of foreign securities.

- Minus estimated unrecorded principal repayments to foreigners on domestic corporate and agency asset-backed securities (zero after Jan. 2023) + estimated foreign acquisitions of U.S. equity through stock swaps – estimated U.S. acquisitions of foreign equity through stock swaps + increase in nonmarketable Treasury Bonds and Notes Issued to Official Institutions and Other Residents of Foreign Countries.

- These are primarily data on monthly changes in banks’ and broker/dealers’ custody liabilities. Data on custody claims are collected quarterly and published in the TIC website.

- “Selected Other Liabilities” are primarily the foreign liabilities of U.S. customers that are managed by U.S. banks or broker/dealers.

- TIC data cover most components of international financial flows, but do not include data on direct investment flows, which are collected and published by the Department of Commerce’s Bureau of Economic Analysis. In addition to the monthly data summarized here, the TIC collects quarterly data on some banking and nonbanking assets and liabilities. Frequently Asked Question 1 on the TIC website describes the scope of TIC data collection.

- Series break at February 2023 for lines 1-21 and the dependent lines 30-32; see TIC press releases of March 15 and April 15, 2023.

Data links from the Treasury

- npr_history-25Jan.csv

- slt_table1 replaces agnsect corpsect stksect treassect-25Jan.csv

- PR table for press-24Jan.csv

- slt_table4 replaces GrandTotal-25Jan.csv

Global Economic Interactions

The TIC data reflects ongoing global economic interactions that influence investment strategies and financial stability in the United States.

This dynamic is shaped by various factors, including trade policies and geopolitical tensions, which can affect both domestic and international markets.

Additional Reading

To Sum Up

The January 2024 TIC data underscores significant shifts in international capital flows impacting U.S financial markets and economic policies.

As these trends continue to evolve, stakeholders must remain vigilant to navigate potential challenges arising from changing global economic conditions and strategic investment decisions.

Sources: The Treasury, HK Law, and US Department of State.

Ivan Alexander Golden, Founder of THX News™, an independent news organization dedicated to providing insightful analysis on current events, prepared this article.